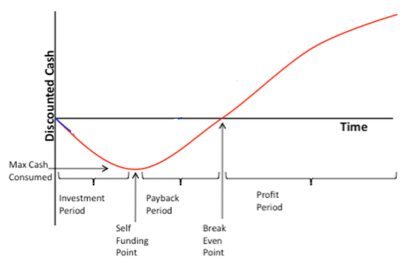

O que é: O Payback é um dos indicadores mais utilizados na análise de retorno de projetos, junto com o Valor Presente Líquido (VPL) e a Taxa Interna de Retorno (TIR). Ele irá indicar o tempo necessário para o lucro acumulado gerado igualar o investimento inicial. Ou seja, ele é demonstrado em unidades de tempo: dias, meses, anos. Cotidianamente, ouvimos falar dele quando alguém diz “você vai ter seu dinheiro de volta em 18 meses.”

Voltar para:

Como fazer um plano de negócios?

Como fazer um plano financeiro?

Quais as vantagens de se usar o payback?

Diferente do cálculo do VPL ou da TIR, o payback tem a característica de se preocupar com o prazo de liquidez do investimento, ou seja, em quanto tempo você vai ter aquele montante de volta no seu bolso. Por isso ele traz benefícios comparativos como:

- Avaliação do risco de liquidez

- Indicador da sua mobilidade financeira

- Aponta sua capacidade de fazer novos investimentos já com os resultados desse

- Incentiva uma melhor definição do capital inicial

- Fortalece a importância da gestão de custos

Como calcular o payback?

O Payback é um indicador bem simples de ser encontrado. No entanto, existe também um método um pouco mais complexo que se chama Payback Descontado. Neste caso primeiro caso, vamos ver como achar o Payback Simples. Em seguida, faremos o mesmo cálculo mas utilizando o método descontado.

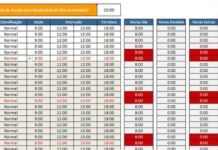

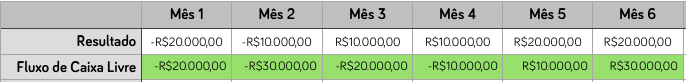

Antes de mais nada, você precisa ter um fluxo de caixa livre acumulado. Isso quer dizer o somatório de todos os fluxos de caixa da sua projeção desde o início ao fim. Normalmente, em novos projetos, os primeiros meses são negativos e depois com o acumulo do resultado positivo operacional, esse valor torna-se definitivamente positivo. Vamos usar um fluxo simples como o abaixo:

O fluxo acima indica que nos dois primeiros meses, o projeto deu prejuízo e o fluxo de caixa livre estava em -R$30.000,00. Esse foi o valor mais baixo do nosso fluxo, que provavelmente se aproxima do capital inicial investido, pois se a empresa não fechou com esse resultado, ela certamente tinha planejado uma reserva.

Após o terceiro mês, a empresa tornou-se operacionalmente lucrativa e começou a “devolver” capital. Isso quer dizer que ela parou de utilizar o caixa de reserva e realmente gerou caixa para o negócio. Como a tendência se seguiu, no quinto mês o fluxo de caixa livre acumulado ficou positivo, indicando que todo o dinheiro investido já havia sido recuperado. É justamente esse o mês que o projeto alcançou seu Payback.

Em um fluxo mais extenso, você pode usar a função CONTSE do Excel e usar o critério menor do que zero (<0) e somar com 1 no final para obter o próximo período. Neste caso, ele iria contar os 4 primeiros meses que estavam negativos e somar com 1 para apontar precisamente o mês 5.

Aplicando o Payback Descontado

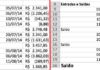

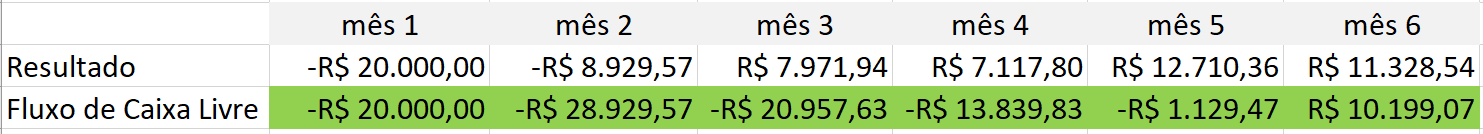

O payback descontado é um método um pouco mais complexo, pois ele envolve a mesma lógica do cálculo do VPL, mas com o intuito de montar um fluxo mais preciso economicamente. Nele, você vai ter que trazer cada um do meses para valor presente. Assim, você vai ter a real noção do valor do dinheiro ao longo do tempo. Vamos ao exemplo. O fluxo acima ficaria dessa maneira:

Podemos notas que os valores de cada fluxo, trazido ao valor presente fica um pouco inferior ao longo do tempo, isso acontece porque o dinheiro agora vale mais do que o dinheiro futuro. Nesse caso, utilizamos uma taxa de 12% ao mês e o que acontece é que o payback que antes ocorria no mês 5, agora só ocorre no mês 6!

Quando usar o Payback Simples e o Descontado

Em praticamente qualquer investimento, nós pensamos no retorno do nosso dinheiro, na maioria das vezes utilizamos o payback simples pela sua simplicidade e essa é sem dúvidas a sua maior força. Por isso, 90% das vezes ele é a melhor saída, principalmente quando são investimentos mais simples e com prazos e riscos menores. Com ele, você consegue uma aproximação muito boa do período que vai demorar para o seu dinheiro voltar.

Sendo assim, o payback descontado só vale a pena de ser calculado quando estivermos pensando em investimentos mais volumosos e com mais complexidade e dinheiro envolvido, pois nesses casos, a diferença de alguns meses no retorno podem representar em montantes relevantes. No mais, como não existe fórmula no Excel para cálculo do payback, ele deve ter feito a mão, o que dá um pouco mais de trabalho.

Esse post esclareceu como obter e interpretar o Payback do seu negócio? Aqui na LUZ, oferecemos diversas ferramentas de gestão para empresas, incluindo uma planilha em excel pronta para estudo de viabilidade de projetos!

Não deixe de conhecê-la!