Uma das maiores demandas no universo de consultoria empresarial está na parte financeira. O Brasil apresenta centenas de empresas com problemas de insolvência ou administrativos. Conheça nesse artigo 5 planilhas para consultoria financeira.

Nesse artigo falaremos sobre:

- Passo 1 – Planilha de Fluxo de Caixa

- Passo 2 – Planilha de Cálculo de Ponto de Equilíbrio

- Passo 3 – Planilha de Formação de Preços

- Passo 4 – Planilha de Estudo de Viabilidade Econômica

- Passo 5 – Planilha de Valuation

- Como você faz na sua consultoria financeira?

A área financeira de um negócio é uma das partes mais essenciais de qualquer empresa. É bem simples, se você não não consegue controlar os seus gastos ou entender o seu ponto de equilíbrio, é bem provável que tenha uma dificuldade em manter um patamar saudável de caixa.

De maneira geral, uma consultoria financeira vai consistir na análise do fluxo de caixa do negócio, no entendimento da precificação, dos principais indicadores financeiros e em projeções futuras para conhecer a viabilidade de um novo negócio ou do próprio valor de mercado da empresa. Para chegar nesse resultado, existem 5 planilhas financeiras que podem te ajudar a organizar esse caminho:

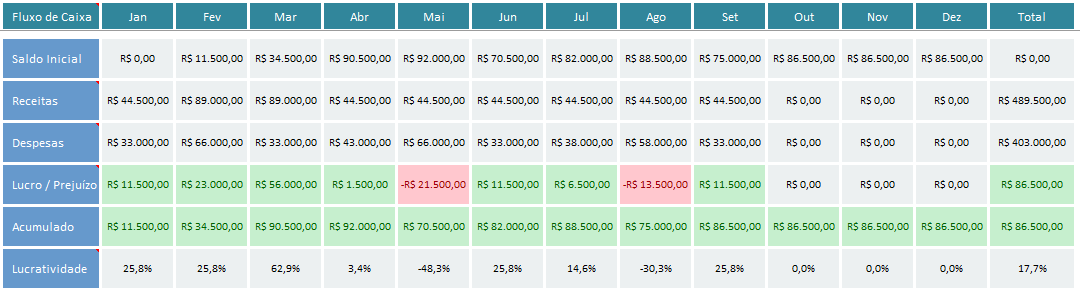

Passo 1. Planilha de Fluxo de Caixa

Esse é o primeiro passo de qualquer organização financeira. Não existe controle financeiro sem conhecimento do fluxo de caixa, por isso é importante conhecer as receitas e despesas do negócio. Com esses dados, é possível se a empresa está dando lucro ou prejuízo, qual a sua lucratividade e o saldo acumulado mês a mês. Na nossa planilha de fluxo de caixa você conseguirá visualizar demonstrativos de fluxo de caixa como o mostrado abaixo:

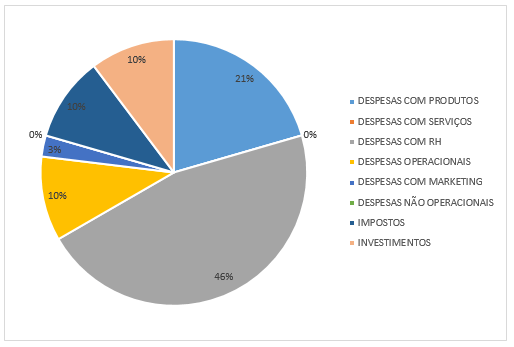

Além dele, ainda é possível fazer análises específicas de custos, de contas a pagar e a receber e até mesmo do DRE (demonstrativo de resultado do exercício). De acordo com os grupos de planos de contas estabelecidos você pode ter ótimas vsualizações como a de divisão de despesas mostrada no gráfico:

O que fazer com essas informações?

- Entender se a empresa está tendo lucro ou prejuízo

- se der lucro, analisar os principais grupos de receitas e ver como lucrar mais com eles

- se der prejuízo, analisar os principais grupos de despesas e ver como reduzir custos desnecessários

- Analisar a tendência de crescimento ou decrescimento do negócio

- Visualizar a necessidade de caixa (capital de giro) para meses futuros a partir do contas a pagar e a receber

- Em caso de necessidade de caixa, avaliar se existe saldo em caixa suficiente para a empresa não entrar no vermelho

- Para negócios com grande volume de vendas (comércio, varejo), fazer análises diárias

- Avaliar especificamente meses com um gasto maior do que o padrão para descobrir oportunidades de corte de custos

Passo 2. Planilha de Cálculo de Ponto de Equilíbrio

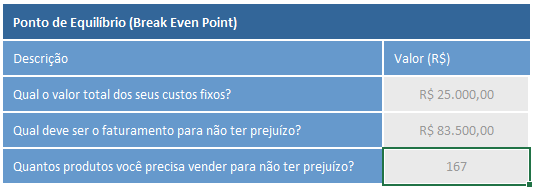

Para quem já tem um controle minimamente decente do seu fluxo de caixa, acredito que o segundo aspecto essencial é descobrir a margem de contribuição e o ponto de equilíbrio dos produtos e serviços do negócio. Dessa forma, além do entendimento financeiro geral, também será possível fazer análises sobre possibilidades de venda e de produção.

Para resumir, a margem de contribuição é a diferença entre o preço de venda e as despesas diretas, enquanto o ponto de equilíbrio é o indicador que mostra a quantidade de produtos ou serviços que precisam ser vendidos para a empresa não ter lucro e nem prejuízo. Como normalmente trabalhamos com empresas que querem lucro, sempre teremos que ter vendas maiores do que as do break even point. Veja um exemplo de cálculo feito na nossa planilha de cálculo de ponto de equilíbrio:

Normalmente esse cálculo é bem simples em casos de empresas com um único produto ou serviço (Ponto de Equilíbrio = Custos Fixos / Margem de Contribuição). Caso sua empresa ou a que você esteja analisando tenha mais do que um produto ou serviço, será necessário fazer o rateio dos custos entre os produtos. Particularmente eu gosto de fazer esse rateio pelo método das projeções de vendas, onde eu pego exatamente a projeção percentual de cada produto ou serviço e divido os custos fixos seguindo esses valores.

O que fazer com essas informações?

- Garantir que os produtos ter margem de contribuição positiva

- Ter certeza que a capacidade produtiva da empresa é maior do que o ponto de equilíbrio

- Ter certeza que existe demanda maior do que o ponto de equilíbrio

- Reduzir custos diretos ou fixos de acordo com a necessidade de tornar o produto/serviço mais competitivo

Passo 3. Planilha de Formação de Preços

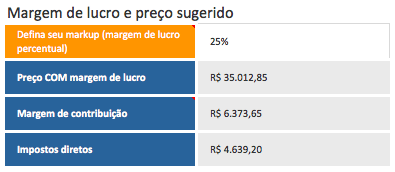

Se você já sabe a quantidade de produtos ou serviços que a empresa precisa vender, um terceiro passo necessário é fazer uma análise mais aprofundada sobre a formação do preço de venda, já que ele vai influenciar diretamente no ponto de equilíbrio. De maneira geral, essa é uma visualização simples da nossa planilha de precificação para serviços:

Como em qualquer outra precificação você precisa ficar atento a alguns itens nesse processo:

- Custos diretos

- Preço de venda

- Margem de contribuição

- Mark up desejado

- Custos fixos

- Preço de concorrentes

- Posicionamento do negócio

- Valor percebido pelos clientes

O que fazer com essas informações?

- Garantir que o preço de venda é maior do que o custo direto do produto

- Ter um diferencial competitivo em relação aos concorrentes

- Se não tiver um diferencial competitivo, comparar preço com os da concorrência

Passo 4. Planilha de Estudo de Viabilidade Econômica

Os três primeiros passos são os mais essenciais para um controle financeiro bem feito, mas podem existir momentos em que o seu cliente deseja ir um pouco além da análise financeira apenas do negócio dele. Normalmente isso ocorre quando existe um desejo por:

- Abrir um novo novo negócio

- Comprar uma nova máquina ou equipamento

- Inaugurar um ponto de venda em uma nova localidade

- Realização de um projeto

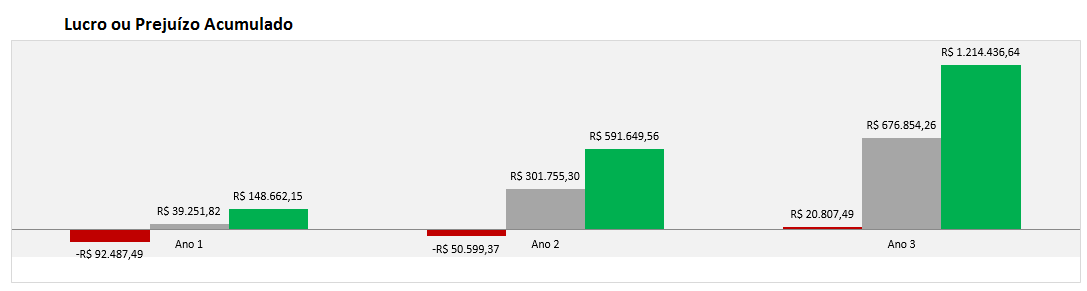

Em todos esses casos, como consultor financeiro, seu papel é de descobrir a viabilidade desses desejos e a melhor maneira de chegar nessa resposta é com uma planilha de estudo de viabilidade econômica como a da LUZ:

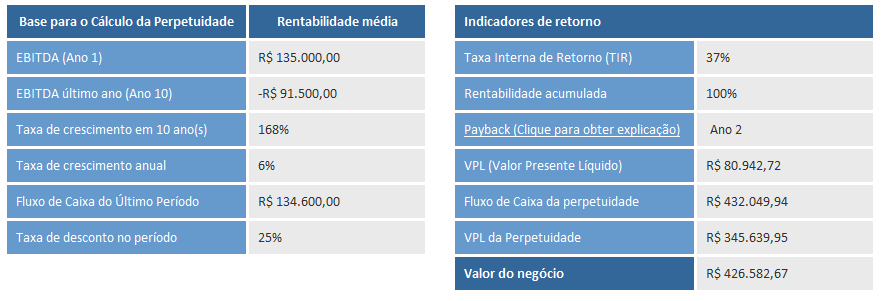

Com ela, basta fazer projeções de investimento, despesas e receitas que você terá os principais indicadores de viabilidade de um negócio (valor presente líquido, taxa interna de retorno e payback).

O que fazer com essas informações?

- Garantir um VPL acima de zero

- Garantir uma TIR acima da taxa de desconto

- Avaliar se o payback está dentro das suas expectativas

- Sempre trabalhar com cenários otimistas e pessimistas

Passo 5. Planilha de Valuation

Por fim, uma outra necessidade que pode surgir para consultores financeiros é a de cálculo do valuation do negócio da pessoa. Normalmente esse método segue um padrão similar ao da EVE, mas utilizando alguns outros indicadores e dados financeiros. Na nossa planilha de valuation você só precisa preencher os principais dados financeiros do seu negócio para para já obter os resultados:

Apesar desse cálculo ser muito comum para empresas que estão buscando a venda, aquisição ou investimento, ele serve para outros casos como em uma análise de quanto o seu negócio vale em comparação com o investimento inicial feito nele.

O que fazer com essas informações?

- Mostrar para potenciais investidores

- Mostrar para potenciais compradores

- Entender se a sua empresa vale mais do que o seu investimento inicial

- Saber o valor do seu negócio a preço de mercado

Como você faz a sua consultoria financeira?

Gostaria de saber a sua opinião aqui nos comentários. Você já contratou uma consultoria financeira? Como foi o processo? Se você é um consultor especializado na área financeira, conta pra gente quais são os passos que você utiliza na sua consultoria.

Para ambos os casos eu recomendo fortemente o nosso pacote de planilhas de finanças empresariais.