Você sabia que o conhecimento e a aplicação correta dos princípios da contabilidade podem melhorar a gestão dos números de sua empresa, possibilitando uma análise mais apurada da saúde financeira e subsidiando as tomadas de decisão? Conheça neste artigo os conceitos dos custos diretos e indiretos e saiba como classificá-los adequadamente. De quebra, conheça uma ótima ferramenta que a Luz.vc preparou especialmente para sua empresa.

Veja também: Guia completo sobre precificação

Custos Diretos

Os custos diretos podem ser identificados como aqueles que estão objetivamente ligados a determinado produto. Devem ser perfeitamente mensuráveis, a fim de serem incluídos de forma direta no cálculo da produção. Dada a facilidade de associação com os produtos, os custos diretos não precisam ser submetidos a critérios de rateio para serem devidamente alocados.

Na grande maioria dos casos, os custos diretos são referentes a materiais (embalagem, matéria-prima, componentes) e mão-de-obra direta, que é aquela aplicada diretamente na fabricação ou acabamento de produtos ou, se for o caso, na prestação de serviços. A tendência é a substituição em escala cada vez maior da mão-de-obra direta pelas máquinas e equipamentos. Além do salário dos funcionários, os custos diretos com a mão-de-obra envolvem ainda os encargos sociais e as provisões de férias e décimo-terceiro salário.

Os custos diretos são incluídos de forma direta no cálculo dos produtos.

Custos Indiretos

Por sua vez, os custos indiretos, como o próprio termo sugere, não são identificados diretamente nos produtos e serviços. Por consequência, os custos enquadrados nesta categoria não podem ser relacionados a produtos específicos, existindo a necessidade de que sejam estabelecidos critérios de rateio para serem devidamente alocados.

Um bom exemplo é a mão-de-obra indireta, referente a atividades realizadas em setores auxiliares da empresa ou por prestadores de serviços, como vigilância, manutenção de equipamentos, limpeza e afins. Também são classificados como custos indiretos os materiais empregados nestas atividades, como lubrificantes e parafusos. A depreciação dos equipamentos, os aluguéis e os seguros também são exemplos de custos indiretos.

A importância em diferenciar os custos diretos dos indiretos

O controle contábil de uma empresa e seu planejamento podem ser melhorados sensivelmente se os custos forem classificados de maneira correta. A fixação dos preços das mercadorias vendidas, por exemplo, pode ser definida de uma forma mais equilibrada quando são levados em conta apenas os custos efetuados especificamente com os produtos. Outra vantagem é um planejamento mais preciso de gastos futuros e eventuais remanejamentos. Os custos indiretos, que não podem ser alocados em um produto específico, são rateados entre os centros de custo.

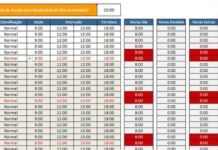

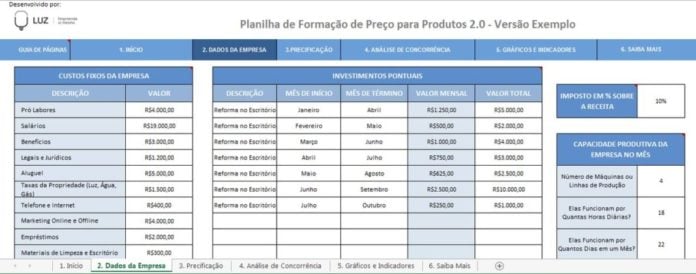

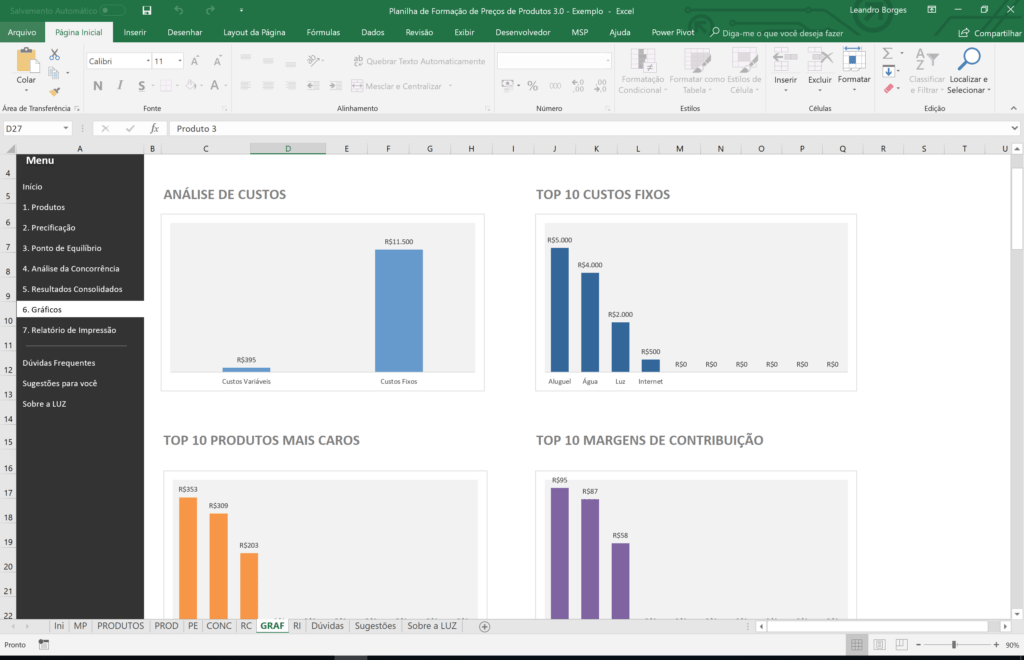

Os fundamentos dos custos diretos e indiretos são aplicados nos diversos métodos de custeio, que são utilizados para obter informações importantes e subsidiar o planejamento e o controle de custos das empresas. Para auxiliar o processo de fixação dos preços dos produtos de sua empresa, a Luz.vc criou a Planilha de Formação de Preços para Produtos.

Dividida em seis abas, a planilha permite estipular os preços a partir de informações referentes a impostos, custos e investimentos, oferecendo ainda a possibilidade de análise de concorrência a fim de realizar ajustes que garantam a competitividade do preço a ser praticado.

Conheça a Planilha de Formação de Preços para Produtos e não perca mais dinheiro ao definir de forma equivocada o preço de seus produtos.