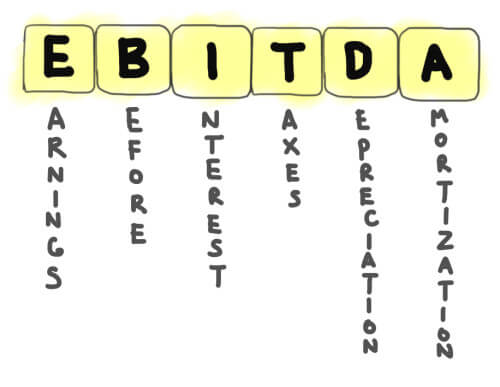

EBITDA é um indicador financeiro muito utilizado em análises de valor de mercado de empresas. Significa “Earns Before Interest, Taxes, Depreciation and Amortization”, ou seja, lucro antes de juros, impostos, depreciação e amortização (LAJIDA) depois de traduzido.

Índice

O que é EBITDA?

O EBITDA é um indicador financeiro muito importante entre analistas, empresários e investidores. É uma visão do potencial financeiro de uma empresa desconsiderando efeitos de taxas, impostos e custos de capital.

Imagine que você está comparando o potencial financeiro de uma empresa com outra. Digamos que a segunda empresa apresente o dobro de lucro líquido em relação a primeira.

Você decide fazer uma análise mais profunda do Balanço Patrimonial e da Demonstração do Resultado do Exercício (DRE). A partir dela, você descobre que a operação da primeira empresa é mais lucrativa. Porém, com empréstimos feitos no passado e uma estrutura de capital fixo inflada, você percebe que o lucro fica prejudicado por causa de juros e depreciação.

O LAJIDA tenta justamente excluir esse tipo de distorção, analisando o potencial financeiro da operação em si. Que é o que analistas e investidores consideram ao fazer o valuation de uma empresa.

Como calcular o EBITDA?

Existem algumas formas de calcular o EBITDA. No final das contas você encontra o mesmo resultado. Alguns exemplos estão abaixo:

Fórmula 1: Lucro Operacional + Depreciação + Amortização

O lucro operacional consiste em Receita Líquida – Custo das mercadorias vendidas (CMV) – Despesas Operacionais. A Fórmula 1 em uma visão mais completa seria:

Fórmula 1: Receita Líquida – CMV – Despesas Operacionais + Depreciação + Amortização

Outra forma de calcular o EBITDA é partindo do resultado do DRE, ou seja, o lucro líquido. Nesse caso, teríamos:

Fórmula 2: Lucro Líquido + Juros + Impostos + Depreciação + Amortização

Essa seria uma versão mais literal do cálculo, já que o nome traduzido do indicador é lucros antes de juros, impostos, depreciação e amortização (LAJIDA).

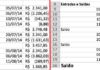

Vamos a um exemplo de EBITDA.

Uma empresa possui receita de 100 milhões, custos diretos de 40 milhões, despesas operacionais de 30 milhões e registra em seu DRE 10 milhões de despesas com depreciação e amortização. O que geraria um lucro operacional de 20 milhões. No entanto, a empresa paga 10 milhões de impostos e 5 milhões de juros.

Esta empresa possui lucro líquido de 5 milhões. mas o seu EBITDA, calculado pela Fórmula 2 é:

5 (lucro líquido) + 10 (D&A) + 10 (impostos) + 5 (juros) = 30 milhões

…pela Fórmula 1:

20 (lucro operacional) + 10 (D&A) = 30 milhões

Aplicações do EBITDA

O EBITDA é muito utilizado em análises de empresas, para calcular o fluxo de caixa livre e projeta-lo, por exemplo.

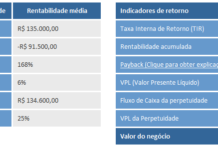

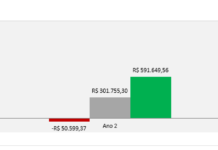

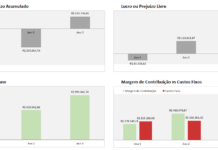

O valuation, que é o cálculo do valor de mercado de uma empresa, é um exemplo de uso do indicador financeiro. O estudo de viabilidade econômica, que mede a viabilidade de um projeto ou de uma ideia de negócio também o utiliza.

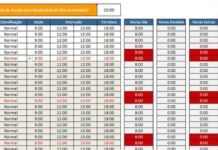

Para fazê-los, temos duas planilhas prontas que podem ajudar: