Até poucos anos atrás, empreendedores que quisessem abrir um novo negócio sozinhos eram “assombrados” pela necessidade do “sócio-fantasma”. Isso porque, antes de 2011, a grande maioria das empresas de pequena proporção deveriam ser registradas e enquadradas no regime de sociedade limitada. O problema é que nem sempre o dono da nova empresa tinha interesse em dividi-la com alguém. Mas ele precisava enfrentar o incômodo de encontrar um sócio, para poder registrá-la. Nesse cenário, muitas pessoas aceitavam entrar como sócios minoritários de um negócio que às vezes mal conheciam, apenas como atores a interpretar seu papel diante da lei. Essa situação mudou há sete anos, com o surgimento da EIRELI, através da lei 12.441

O que é uma EIRELI

A EIRELI, ou Empresa Individual de Responsabilidade Limitada, possibilita a constituição de uma empresa apenas com o próprio empresário, sem necessidade de duas ou mais pessoas. Dessa forma, o dono da empresa pode separar o seu nome pessoa jurídica de seu nome pessoa física. Ou seja, suas responsabilidades sobre a empresa não afetam sua vida particular. Por exemplo, caso seus negócios gerem dívidas, o seu patrimônio pessoal não será atingido.

Benefícios de se abrir uma Eireli

O Sebrae demonstra que a EIRELI é uma alternativa muito vantajosa para os micro e pequenos empreendedores. Entre outras coisas, porque:

- O titular tem responsabilidade limitada, protegendo seus bens pessoais;

- Mesmo trabalhando individualmente, o empresário tem sua identidade jurídica;

- O registro evita a informalidade de novos empreendedores;

- O empresário pode escolher dentre vários regimes de tributação, inclusive o Simples Nacional;

- A EIRELI abrange uma ampla gama de atividades comerciais, industriais rurais ou serviços;

- O novo empreendedor não precisa procurar um “sócio-fantasma” para responder à legislação.

Diferenças entre uma EIRELI, MEI, EI e LTDA

- MEI: Dois anos mais antiga que a EIRELI, a constituição do Microempreendedor Individual foi introduzida pela Lei Complementar 128/08 e inserida na Lei Geral da Micro e Pequena Empresa (Lei Complementar 123/06). Desenvolvido para combater a informalidade, o MEI tem direitos como auxílio-doença e aposentadoria. Entretanto, o limite de faturamento anual é de R$ 81.000, só pode contratar um funcionário e há uma limitação de profissões que podem se enquadrar nessa categoria.

- EI: No caso de as restrições do MEI seriam inviáveis, o microempreendedor tem a opção de ser tornar Empresário Individual. O limite de faturamento anual sobe, não há limites para contratação de funcionários e engloba um número muito maior de atividades econômicas. Contudo, nesse sistema, não há personalidade jurídica, isto é, a pessoa física responde pelos deveres da empresa, inclusive, endividamento e falência.

- EIRELI: é o modelo mais recente de todos. Essa alternativa é mais vantajosa sobre o EI porque protege a pessoa física, que tem sua identidade separada da pessoa jurídica. Entretanto, o capital social precisa ser equivalente a 100 salários mínimos vigentes na abertura da empresa.

- LTDA: A sociedade limitada consiste numa associação baseada no valor investido na empresa por cada um dos sócios. É baseada num contrato social, que determina ônus e bônus de cada um, de acordo com a quantidade de cotas que possuem. Todos respondem solidariamente pela integralização do capital social, mas têm seu patrimônio pessoal protegido, separado da pessoa jurídica.

Como abrir uma EIRELI

A abertura de uma EIRELI é semelhante a qualquer outra empresa. Deve-se começar pela elaboração do Ato Constitutivo (documento equivalente ao Contrato Social), proceder ao registro na Junta Comercial, bem como inscrições estadual e municipal e, por fim, aquisição de alvarás e licenças correspondentes à atividade econômica.

Faturamento

A EIRELI pode ser classificada como Microempresa (ME), com faturamento máximo de R$ 360 mil anuais, ou como Empresa de pequeno porte (EPP), com limite de R$ 3,6 milhões ao ano. Mas não há um limite de faturamento. Pois, caso ela passe dos valores citados, ela muda de regime de tributação somente.

Impostos

A EIRELI pode ser enquadrada em três regimes de tributos:

- Simples Nacional: somente para os casos de ME e EPP. A carga dependerá da atividade exercida, com alíquotas que variam de 4% a 19,5%.

- Lucro Real: os impostos são calculados sobre o lucro líquido do período de apuração. Contempla o Imposto de Renda Pessoa Jurídica (IRPJ), que é de 15%, e a Contribuição Social sobre Lucro Líquido (CSLL), que varia entre 9% a 12%. Se não houver lucro, não há incidência.

- Lucro presumido: a apuração do IRPJ e da CSLL tem uma base de cálculo prefixada, de acordo com a atividade exercida. As margens variam de 8% a 32%.

Capital social

O capital social de uma EIRELI, isto é, o valor para integralização da empresa, deve ser cem vezes o salário mínimo. Isso é uma garantia para credores e empregados, em caso de falência. Em números, para 2018, significam R$ 95.400,00. Esse capital pode incluir bens, como imóveis ou automóveis, o que deverá ser informado no ato constitutivo e protocolado na Junta Comercial.

Como gerir uma EIRELI

Uma EIRELI, como qualquer empresa, depende de uma boa gestão para sem bem-sucedida. E uma gestão de sucesso inclui controle e acompanhamento de entradas e saídas, adequação de tributos, análises de contas e custos, além de um bom planejamento estratégico, que permita definir metas e examinar resultados.

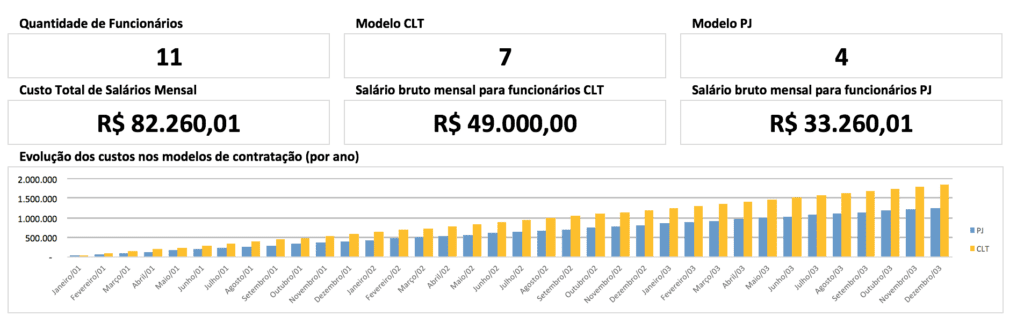

Controle Financeiro

Para um controle financeiro adequado, você precisa contar com uma planilha de controle financeiro completo. Uma planilha que inclua fluxo de caixa, cadastro e análise de bancos, DREs detalhados, indicadores financeiros e gráficos comparativos. Ou seja, que apresente todos os detalhes da vida financeira da sua empresa, para que você tenha um panorama completo de lucros e despesas e possa adequar seus planos e metas de acordo.

Planejamento Estratégico

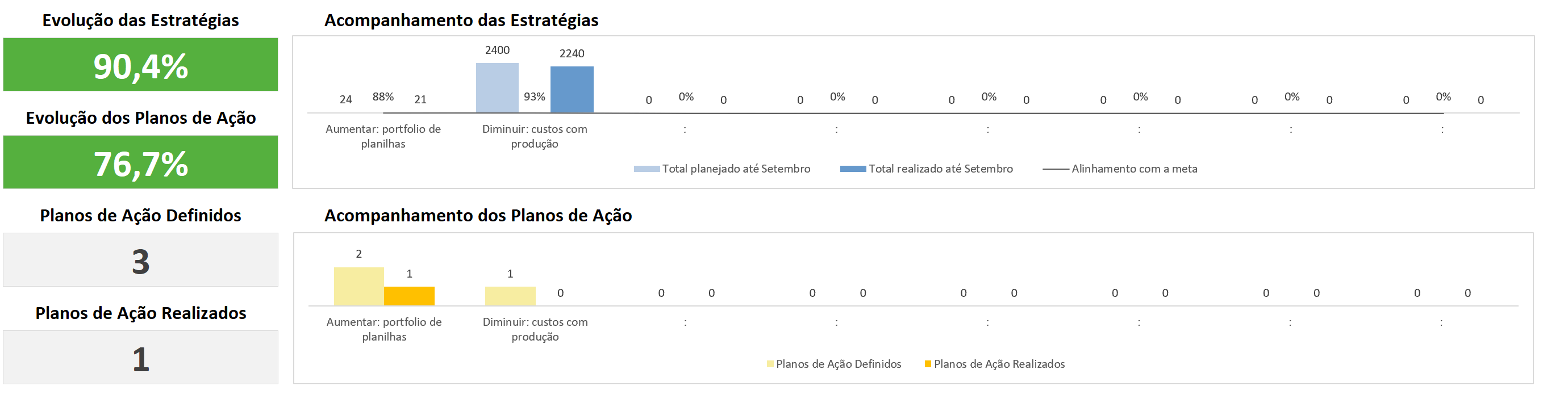

Um bom planejamento estratégico é a garantia de sucesso de sua empresa no mercado, pois direciona as ações da empresa através de um diagnóstico de ameaças e oportunidades. E esse planejamento se torna muito mais simples e claro, com uma planilha de planejamento estratégico detalhada, que lhe permita acompanhar metas, ações e resultados, através de relatórios completos, conseguidos a partir da alimentação de dados básicos.

Se você ainda não tem essas planilhas para sua EIRELI, conheça nossas planilhas para gestão e garanta os melhores resultados para sua empresa!